Sky rocket your Revenue Growth

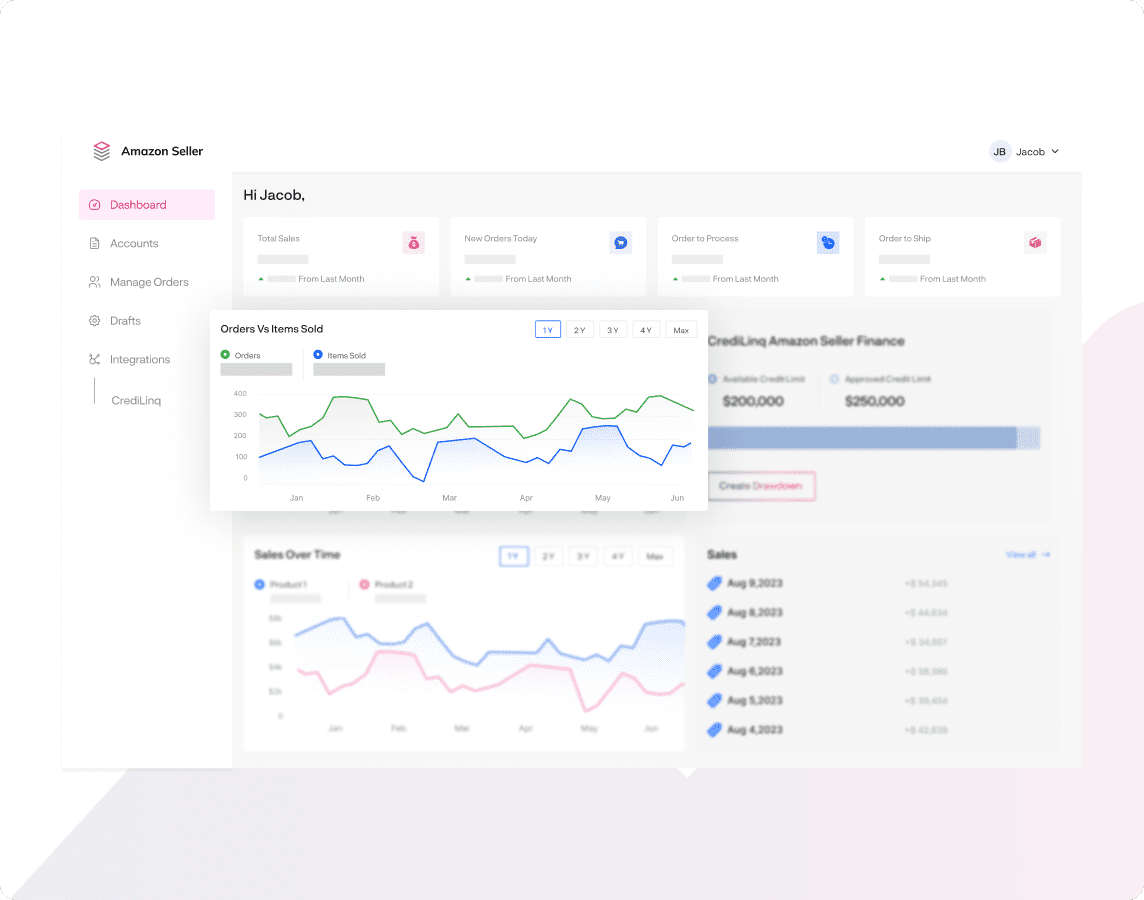

Take a deep dive into your organization’s finances and understand your cashflow, top inflow-outflow transactions and much more

Increase Revenue

Increase your revenue by unlocking new opportunities.

Daily EOD Balances

Instantly access a working capital line of credit.

Grow Equity

Grow your equity while avoiding the need for additional funding.

Competitive Edge

By embracing innovation you can scale ahead of your competitors.

B2B Finance For

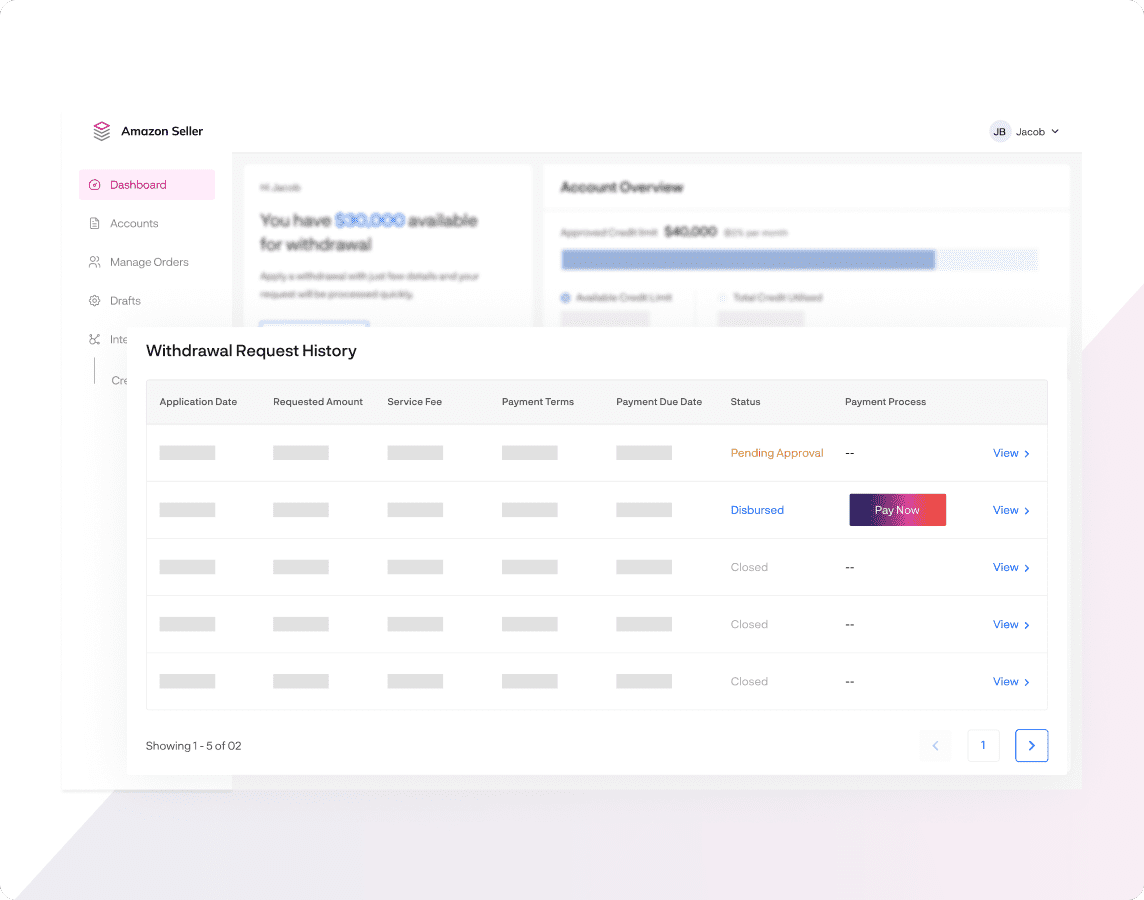

Borrow in Multiples & Repay in Installments

Capital is calculated in multiples of your monthly recurring revenue.

Repay via monthly installments & enjoy competitive interest rates.

Consistently grow your revenue & access additional capital.

Expert Mentorship for Every Challenge

Board of advisors for professional guidance.

Holistic tools designed to track your growth & spends.

Accurate forecasts of future growth.

Instant Evaluation & Approval

Robust analytics for through assessments.

Online portal for uploading transaction history.

Transparent & unbiased decisions.

Customer Success Stories

Frequently Asked

What is Recurring Revenue Financing?

How do I apply for Recurring Revenue Financing?

Do I need to complete a physical application form?

When will I be informed of my approval status?

Do I need to submit my invoices to get approved?

When can I access the funds?

How can I use the approved amount?

Does Recurring Revenue Financing charge hidden fees?

What are the penalties for late payment?

Unleash Your Business Potential with CrediLinq